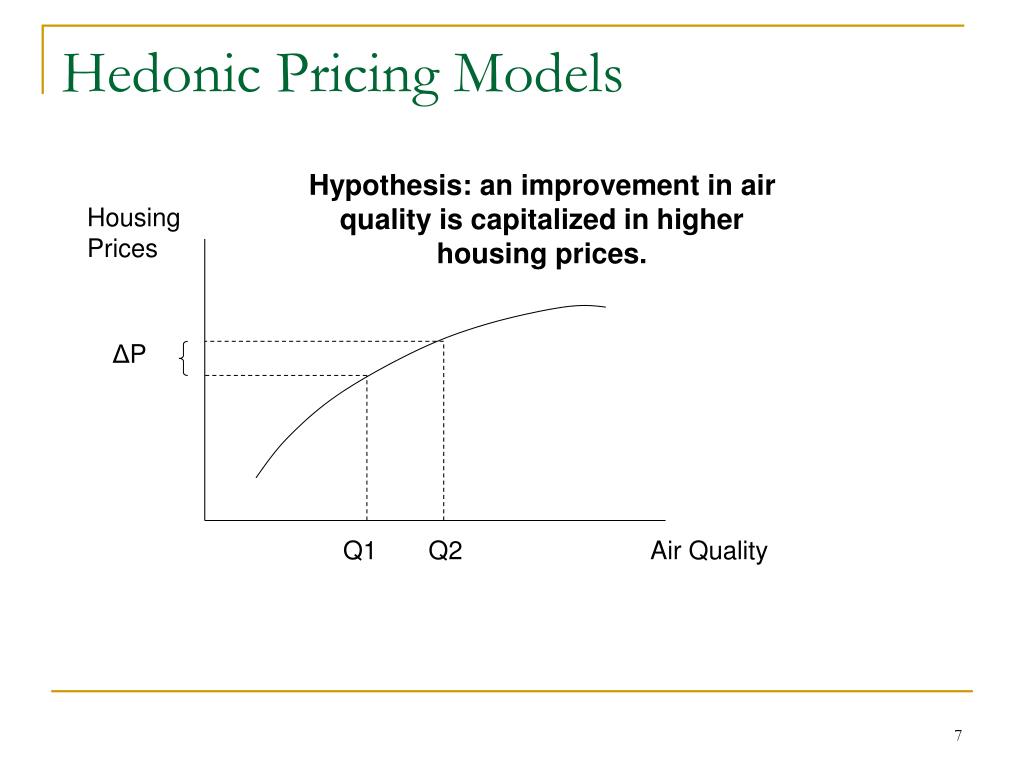

The estimate of the model -based on data- generates an equation where the coefficients are called hedonic prices (or implicit prices, because the identification of the prices for each attribute is done indirectly). The created model tries to relate the price with these attributes. In this context, a real estate is a “compound good” described by a set of attributes. These models follow the theory of hedonic pricing, which has important contributions from ( Lancaster 1966), ( Griliches 1971), ( Rosen 1974) and ( Goodman 1978), among others.

In that case, hedonic pricing models gain importance. 2001) ( Robinson 1979).Ĭonsequently, it is easy to perceive that many attributes have to be considered simultaneously in the analysis of the real estate market, which probably has different values for each situation. Since the product cannot undergo a spatial relocation, the moves in the surroundings can improve or worsen the conditions of the property ( Din et al. On the other hand, the location, often indicated as the most influencing factor on housing prices, also depends on the preferences of the society. If the demand decreases, prices go down, because the owner or producer needs to reduce the prices in order to recover potential consumers ( Balchin and Kieve 1986) ( Sheppard 1999). When the demand increases, the prices increase in the short term, based on the fact that it is impossible to make a spatial relocation of the offer and that it takes time to deal with a higher demand. These features have an impact on the prices when the supply and demand conditions are altered. In addition to the heterogeneity, there are other elements that make the real estate market different from other markets, such as the immobility of the product and the time needed for the project and construction of new units. The property valuation is developed with different methods, where the comparative method, based on the regression analysis, has been considered an option because it allows a good precision and objectivity ( Appraisal Institute 2001) ( Pagourtzi et al. This makes it more difficult or prevents the direct comparison of its units and suggests the use of models for calculating the price. The properties offering the highest number of characteristics desired by the buyers will have higher prices, and the properties with less characteristics will have lower prices ( Robinson 1979) ( Sheppard 1999).Ī relevant characteristic of the market is the real estate heterogeneity. In this context, the preferences of the consumers are basically explained by the prices. It is a common practice to assess the importance of the goods for the society through their prices. The housing market is an important segment of the urban economy. It is important to demonstrate that you can develop simple price models, without having a big staff or elevated costs to collect and analyze data. In general, small and mid-size cities have still not adopted regression-based models for the valuation, partly because they have the reputation of needing a difficult equation building. In order to build the models, it is necessary to demarcate the market area to be explored, define the variables to be included in the model, obtain a reliable and good-sized data sample and treat data through statistical analyses ( Appraisal Institute 2001). This type of pricing model can be used, for example, in tax valuations, which aim at calculating property taxes, sales taxes and capital gain taxes. The objective of the study if to present hedonic pricing models for the housing market in Lajeado and Montenegro, two mid-size cities located in the south of Brazil.

Keywords: real estate valuation market value hedonic pricing models It can be concluded that the models developed are useful in tax valuations. Significance tests for the variables and the model were carried out, and they showed that models have a good explanatory power regarding the prices. The statistical analysis allowed obtaining the equations that best fitted the collected data. The data was collected from real estate agencies and commercial assessment reports. This paper studies two mid-size Brazilian cities, Lajeado and Montenegro, demonstrating the process of analysis and developing real estate pricing models. This matter represents a barrier for the widespread use of statistical inference in tax valuation, especially in small and mid-size cities, which have less resources. In the case of taxes, models must be broad, aiming at the valuation of a group of properties, which makes the work seem more complex. Pricing models serve different purposes, such as calculating real estate taxes or analyzing real estate financing. This work presents a study on real estate pricing using hedonic 3 pricing models.

0 kommentar(er)

0 kommentar(er)